Cleveland-Cliffs将于2019年12月3日收购AK Steel

FORWARD-LOOKING STATEMENTS This presentation contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. As a general matter, forward-looking statements relate to anticipated trends and expectations rather than historical matters. Forward-looking statements are subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and may be beyond our control. Such uncertainties and factors may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These statements speak only as of the date of this presentation, and we undertake no ongoing obligation, other than that imposed by law, to update these statements. Uncertainties and risk factors that could affect our future performance and cause results to differ from the forward-looking statements in this presentation include, but are not limited to: our ability to successfully complete the transaction discussed in this presentation, successfully integrate the acquired business and achieve the strategic and other objectives of the proposed transaction, including achieving the expected synergies; our ability to complete the proposed merger of Cleveland-Cliffs and AK Steel on anticipated terms and timetable; our ability to obtain the required approvals by Cleveland-Cliffs’ shareholders and AK Steel’s stockholders and to satisfy various other conditions to the closing of the transaction contemplated by the merger agreement; our ability to obtain governmental approvals of the transaction on the proposed terms and schedule, and any conditions imposed on the combined company in connection with consummation of the transaction; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of AK Steel; uncertainty and weaknesses in global economic conditions, including downward pressure on prices caused by oversupply or imported products, reduced market demand and risks related to U.S. government actions with respect to Section 232 of the Trade Expansion Act (as amended by the Trade Act of 1974), the United States-Mexico-Canada Agreement and/or other trade agreements, treaties or policies; continued volatility of iron ore and steel prices and other trends, which may impact the price-adjustment calculations under our sales contracts; our ability to successfully diversify our product mix and add new customers beyond our traditional blast furnace clientele; our ability to cost-effectively achieve planned production rates or levels, including at our HBI plant; our ability to successfully identify and consummate any strategic investments or development projects, including our HBI plant; the impact of our customers reducing their steel production due to increased market share of steel produced using other methods or lighter-weight steel alternatives; our actual economic iron ore reserves or reductions in current mineral estimates, including whether any mineralized material qualifies as a reserve; the outcome of any contractual disputes with our customers, joint venture partners or significant energy, material or service providers or any other litigation or arbitration; problems or uncertainties with sales volume or mix, productivity, tons mined, transportation, mine closure obligations, environmental liabilities, employee-benefit costs and other risks of the mining industry; impacts of existing and increasing governmental regulation and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorization of, or from, any governmental or regulatory entity and costs related to implementing improvements to ensure compliance with regulatory changes; our ability to maintain adequate liquidity, our level of indebtedness and the availability of capital could limit cash flow available to fund working capital, planned capital expenditures, acquisitions and other general corporate purposes or ongoing needs of our business; our ability to continue to pay cash dividends, and the amount and timing of any cash dividends; our ability to maintain appropriate relations with unions and employees; the ability of our customers, joint venture partners and third party service providers to meet their obligations to us on a timely basis or at all; events or circumstances that could impair or adversely impact the viability of a mine or production plant and the carrying value of associated assets, as well as any resulting impairment charges; uncertainties associated with natural disasters, weather conditions, unanticipated geological conditions, supply or price of energy, equipment failures and other unexpected events; adverse changes in interest rates and tax laws; the potential existence of significant deficiencies or material weakness in our internal control over financial reporting; and the risks that are described from time to time in Cleveland-Cliffs’ and AK Steel’s respective reports filed with the SEC. For additional factors affecting the business of Cleveland-Cliffs and AK Steel, refer to Part I – Item 1A. Risk Factors of our corresponding Annual Reports on Form 10-K for the year ended December 31, 2018. You are urged to carefully consider these risk factors. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA and Free Cash Flow. Non-GAAP financial measures such as Adjusted EBITDA and Free Cash Flow should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Important Information About the Transaction and Where to Find It In connection with the proposed transaction involving AK Steel Holding Corporation (“AKS”) and Cleveland-Cliffs Inc. (“CLF”), CLF will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of AKS and CLF, which also constitutes a prospectus of CLF. AKS and CLF may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that AKS or CLF may file with the SEC. The definitive joint proxy statement/prospectus will be sent to the stockholders of AKS and the shareholders of CLF. INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by AKS or CLF through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by AKS will also be available free of charge on the AKS website at www.aksteel.com or by contacting AKS’s investor relations department at the below address. Documents filed with the SEC by CLF will also be available free of charge on CLF’s website at shxigumohe.com or by contacting CLF’s investor relations department at the below: AK Steel: 513-425-5215 ; Cleveland Cliffs: 216-694-5700 1

ADDITIONAL STATEMENTS Participants in the Solicitation AKS, CLF and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding AKS’ directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is set forth in AKS’ Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC on February 15, 2019 (the “AKS 10-K”), and its proxy statement filed with the SEC on April 10, 2019. Information regarding CLF’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is set forth in CLF’s Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC on February 8, 2019 (the “CLF 10-K”), and its proxy statement filed with the SEC on March 12, 2019. Additional information regarding the interests of these participants and other persons who may be deemed participants in the proposed transaction may be obtained by reading the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when such materials become available. Free copies of these documents may be obtained from the sources indicated above. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Cautionary Notes on Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “would,” “target” and similar expressions, as well as variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements reflect AKS’s and CLF’s current beliefs and judgments and are not guarantees of future results or outcomes. Forward-looking statements are based on assumptions and estimates that are inherently affected by economic, competitive, regulatory, and operational risks and uncertainties and contingencies that may be beyond AKS’s or CLF’s control. They are also subject to inherent risks and uncertainties that could cause actual results or performance to differ materially from those expressed in any forward- looking statements. Important risk factors that may cause such a difference include (i) the completion of the proposed transaction on the anticipated terms and timing or at all, including obtaining shareholder and regulatory approvals and anticipated tax treatment, (ii) potential unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, economic performance, indebtedness, financial condition, losses and future prospects, (iii) the ability of CLF to integrate its and AKS’s businesses successfully and to achieve anticipated synergies, (iv) business and management strategies for the management, expansion and growth of the combined company’s operations following the consummation of the proposed transaction, (v) potential litigation relating to the proposed transaction that could be instituted against AKS, CLF or their respective directors, (vi) the risk that disruptions from the proposed transaction will harm AKS’ or CLF’s business, including current plans and operations, (vii) the ability of AKS or CLF to retain and hire key personnel, (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction, (ix) uncertainty as to the long-term value of CLF’s common stock, (x) continued availability of capital and financing and rating agency actions, (xi) legislative, regulatory and economic developments and (xii) unpredictability and severity of catastrophic events, including acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Other factors that may present significant additional obstacles to the realization of forward looking statements or which could have a material adverse effect on AKS’ or CLF’s respective consolidated financial condition, results of operations, credit rating or liquidity are contained in AKS’s and CLF’s respective periodic reports filed with the SEC, including the AKS 10-K and CLF 10-K. Neither AKS nor CLF assumes any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by applicable law. 2

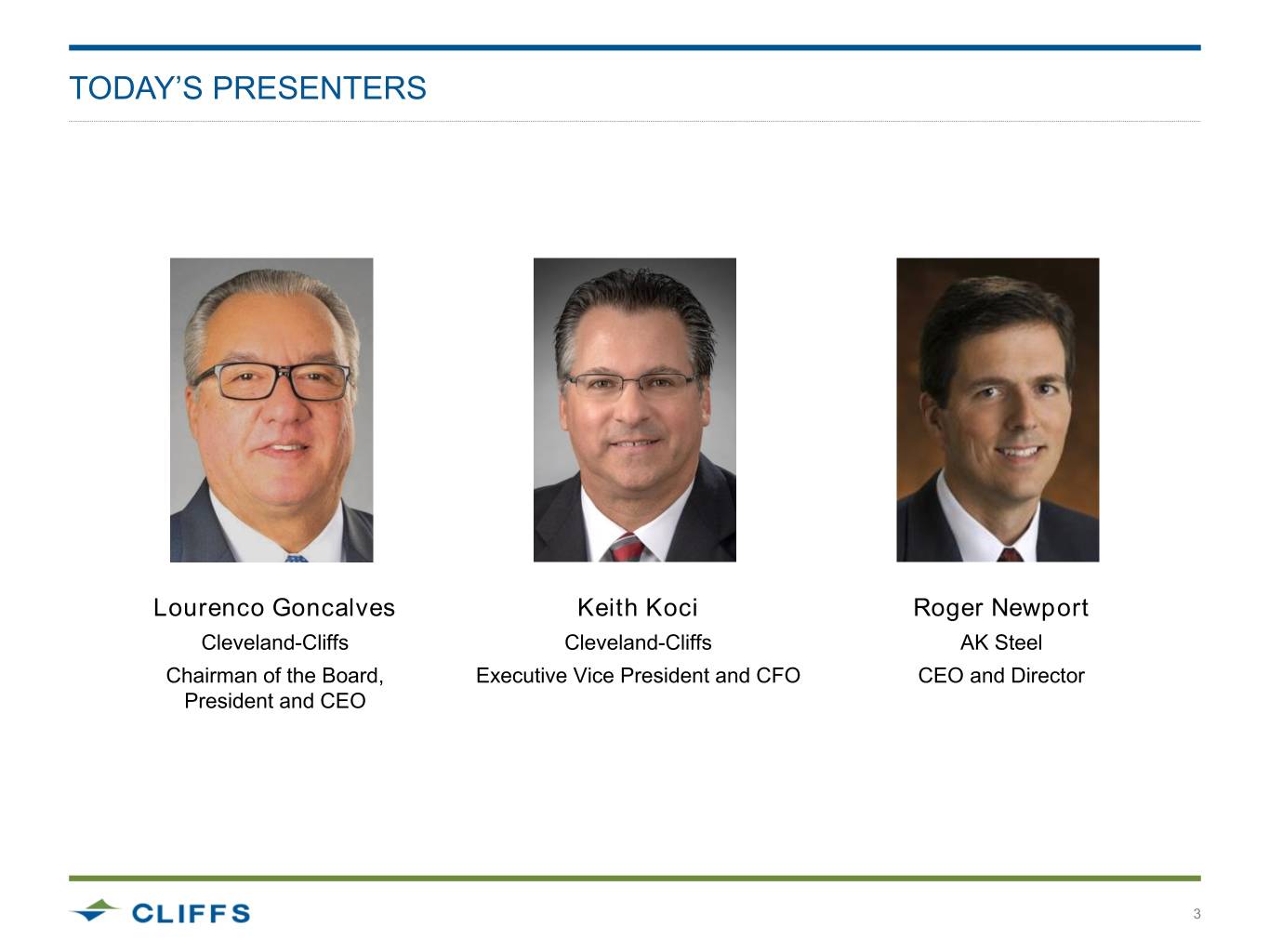

今天的演讲者是lorenco Goncalves Keith Koci Roger Newport Cleveland-Cliffs Cleveland-Cliffs AK Steel董事会主席、执行副总裁兼首席财务官、董事总裁兼首席执行官

皇冠体育-皇冠体育斯收购AK STEEL概述•皇冠体育-皇冠体育斯将以0.400倍的换股比率收购AK STEEL•与AK STEEL截至12月2日的股价相比,该交易溢价16%。•交易意味着AK Steel的总企业价值(1)约为30亿美元,收购和所有权倍数为5.6倍LTM(2019年9月30日调整后EBITDA)(2)•皇冠体育-皇冠体育斯和AK Steel的股东将分别拥有PF公司约68%和32%的股份•公司将保留皇冠体育-皇冠体育斯的名称和纽约证券交易所股票代码(CLF)•AK Steel将成为一家直接、(3)公司名称和总部仍将位于俄亥俄州皇冠体育,同时AK Steel将继续在其位于俄亥俄州西切斯特总部的现有办事处开展业务。•AK Steel的实体将保持其品牌和企业形象。•Lourenco Goncalves将继续担任董事长、总裁兼首席执行官。•2名现任皇冠体育-克利夫斯董事会成员将卸任•3名现有AK Steel董事会成员将在交易完成后加入皇冠体育-克利夫斯董事会,使皇冠体育-克利夫斯董事会成员总数达到12人•杠杆中性交易,预估总债务与Adj. EBITDA的比率为3.5倍(LTM为2019年9月30日)财务状况和•每年约1.2亿美元的成本协同效应;•瑞士信贷将提供约20亿美元的融资承诺,用于新的ABL和AK钢铁2023年现有担保票据的再融资•交易已获得皇冠体育-皇冠体育斯和AK钢铁董事会的一致批准时间和交割•交易预计将于2020年上半年完成。(1)企业价值定义为股权市场价值+总债务-现金。截至2019年9月30日,AK钢铁的债务和现金余额分别为19.7亿美元和3100万美元。(2) AK Steel LTM 2019年9月30日调整后EBITDA为5.35亿美元。4 (3) AK Steel股票将在交易结束后摘牌。

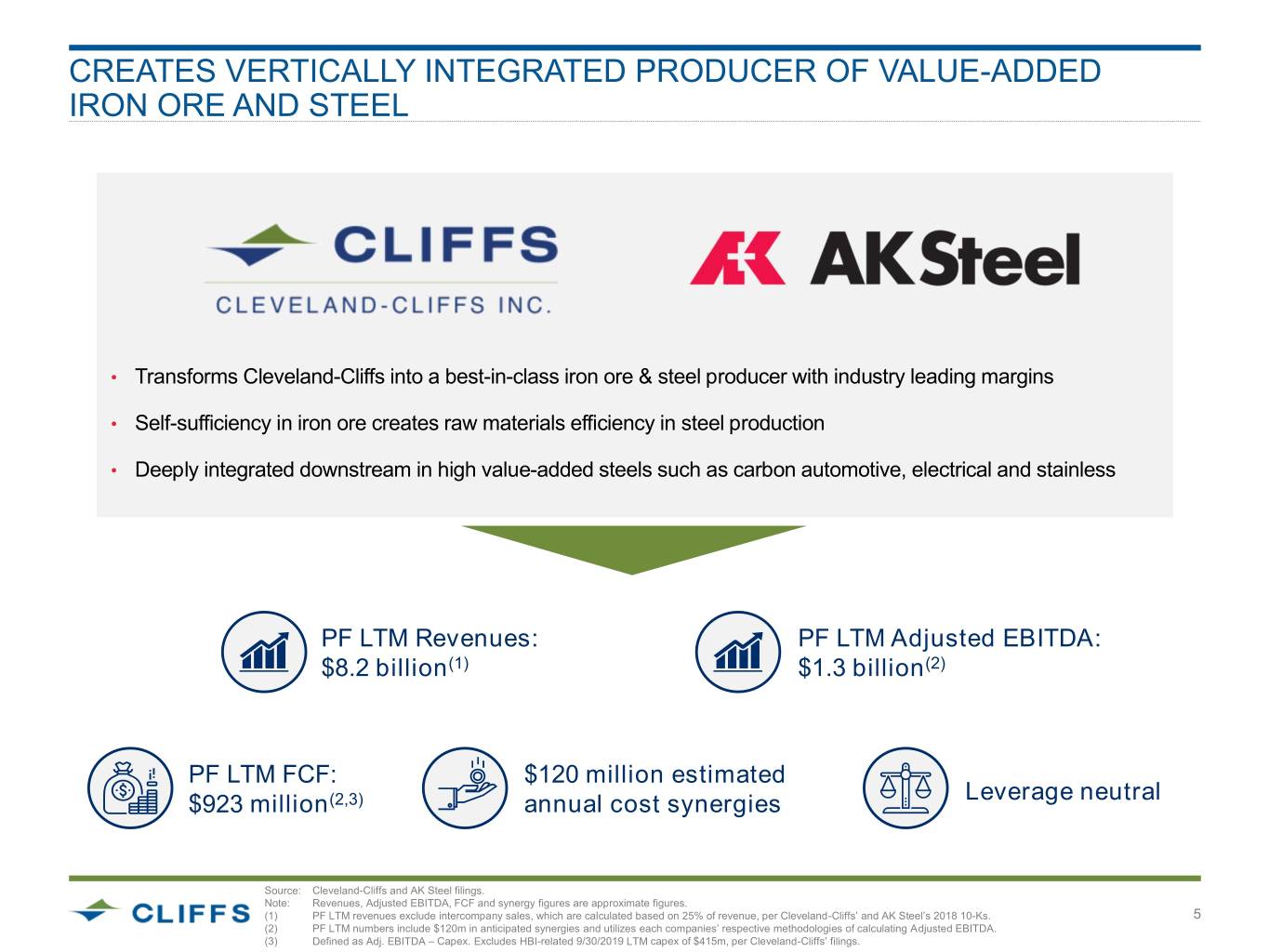

创建垂直整合的增值铁矿石和钢铁生产商•将皇冠体育-皇冠体育斯转变为业内领先的铁矿石和钢铁生产商•铁矿石的自给自足创造了钢铁生产的原材料效率•深度整合下游的高附加值钢材,如碳汽车,电气和不锈钢PF LTM收入:PF LTM调整后EBITDA: 82亿美元(1)13亿美元(2)PF LTM FCF1.2亿美元估计杠杆中性9.23亿美元(2,3)年成本协同效应来源:Cleveland-Cliffs和AK Steel的文件。注:收入、调整后息税折旧摊销前利润、现金融资额和协同效应均为近似值。(1) PF LTM收入不包括公司间销售,公司间销售是根据皇冠体育-皇冠体育斯和AK Steel的2018年10- k收入的25%计算的。5 (2) PF LTM数字包括1.2亿美元的预期协同效应,并利用每家公司各自的计算调整后EBITDA的方法。(3)定义为Adj. EBITDA -资本支出。根据Cleveland-Cliffs的文件,不包括2019年9月30日与hbi相关的4.15亿美元LTM资本支出。

交易原理和产业逻辑令人信服将AK Steel的高质量钢铁资产与高质量铁矿石球团的可靠供应相结合,通过节省原材料成本,创建一个垂直整合的钢铁制造商,拥有行业领先的利润率。由于专注于增值和非商品化产品,减少对波动商品指数的影响,产生更可预测的收益和现金流,提高皇冠体育-皇冠体育斯球团的收入流确定性通过亚什兰生铁工厂,为金属行业创造了潜在的、未来的低资本支出增长机会,预计每年可产生约1.2亿美元的成本协同效应,其中包括每年约4000万美元的上市公司相关成本节约6

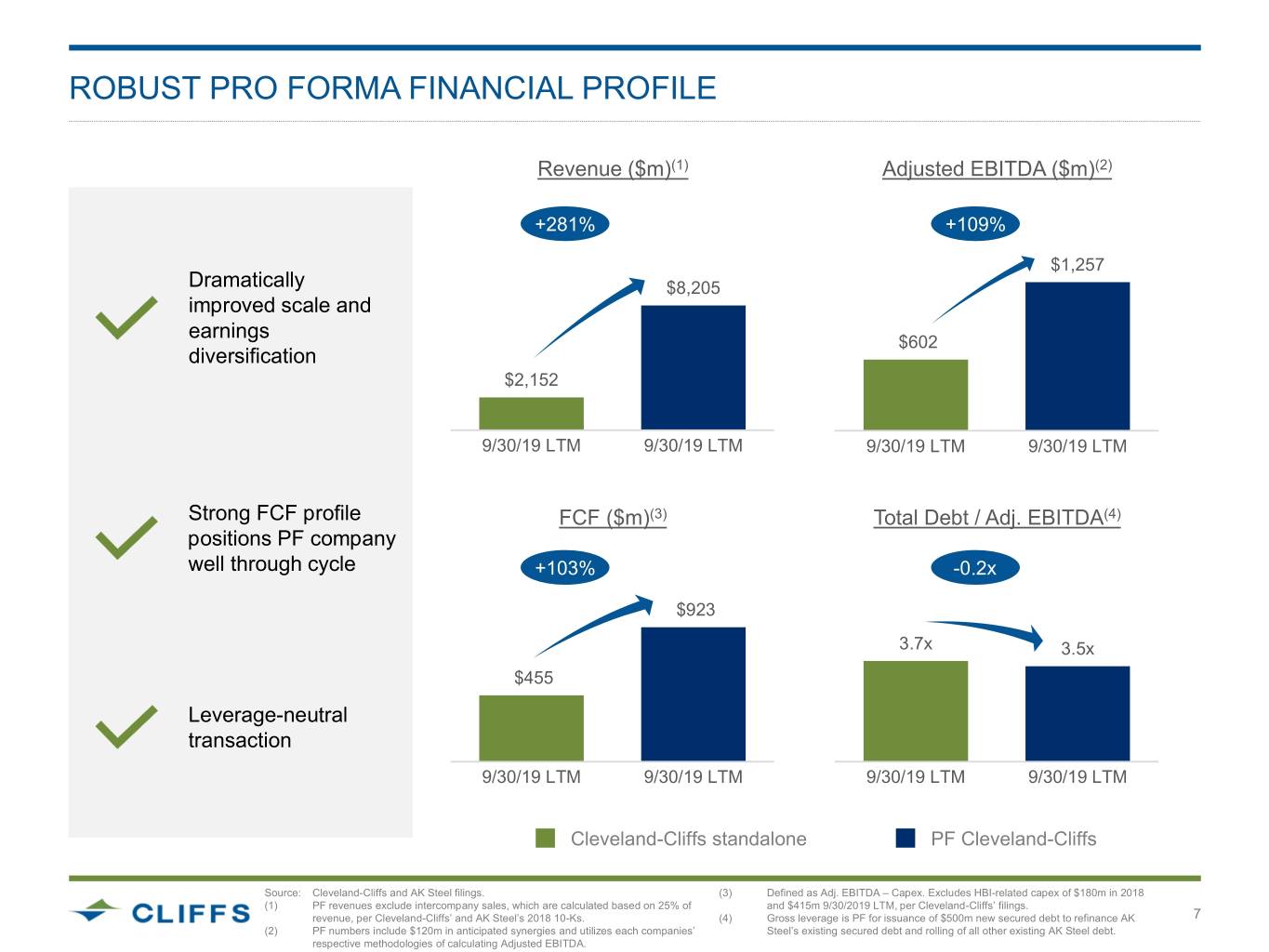

稳健的预估财务状况收入(百万美元)(1)调整后EBITDA(百万美元)(2)+281% +109%美元1,257美元规模和收益大幅改善8,205美元多元化经营$602美元2,152美元19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日LTM 19年9月30日杠杆中性交易+103% -0.2倍$923 3.7x 3.5x $455皇冠体育-皇冠体育斯和AK钢铁公司的文件。(3)定义为Adj. EBITDA -资本支出。不包括2018年与hbi相关的1.8亿美元资本支出。(1)根据皇冠体育-皇冠体育斯的文件,PF收入不包括公司间销售额,该销售额是根据LTM的25%和4.15亿美元计算的。根据皇冠体育-克利夫斯和AK钢铁公司2018年10- k的收入。(4)总杠杆是PF,用于发行5亿美元的新担保债务,为AK再融资7 (2)PF数字包括1.2亿美元的预期协同效应,并利用每家公司的钢铁现有担保债务和所有其他现有AK钢铁债务的滚动。各自计算调整后EBITDA的方法。

交易创造了北美钢铁行业领先的EBITDA利润率•皇冠体育-克利夫斯目前生产并出售给AK钢铁的每个颗粒的利润率约为30- 40美元/短吨•这种利润率差异是PF公司可用的杠杆,而AK钢铁则无法独立使用•关键在于,与其他钢铁生产商相比,它使PF公司更具竞争力行业最佳的Adj. EBITDA/短吨指标(1)... ... Adj. EBITDA利润率优于EAFs(1) $146 15.0% $132 $127 13.1% 12.8% $98 8.1% 7.7% $61 7.0%(3) $41预估(2)预估(4)皇冠体育-克利夫斯的预估指标是在调整AK Steel的独立铁指标后计算的(乘以0.75),乘以皇冠体育-克利夫斯约40美元/短吨的球团利润(直接从皇冠体育-克利夫斯购买矿石成本节省的高端)。指标包括皇冠体育的第三方范围)除以年初至今约410万短吨的钢铁产量。颗粒销售和利用每个公司各自的方法计算调整后的EBITDA。(3)仅钢。每短吨EBITDA。8(1)基于2019年9月30日至今。(4)包括9000万美元的协同效应(1.2亿美元年度协同效应的年初至今部分),并占(2)增量~ 48美元/短吨。AK Steel的EBITDA利润率计算为~ 490万短吨铁的公司间销售,这是根据AK Steel年初购买的皇冠体育-克利夫斯和矿石颗粒的25%收入计算的(假设基于AK Steel 2018年10-Ks的2018财年出货量)。

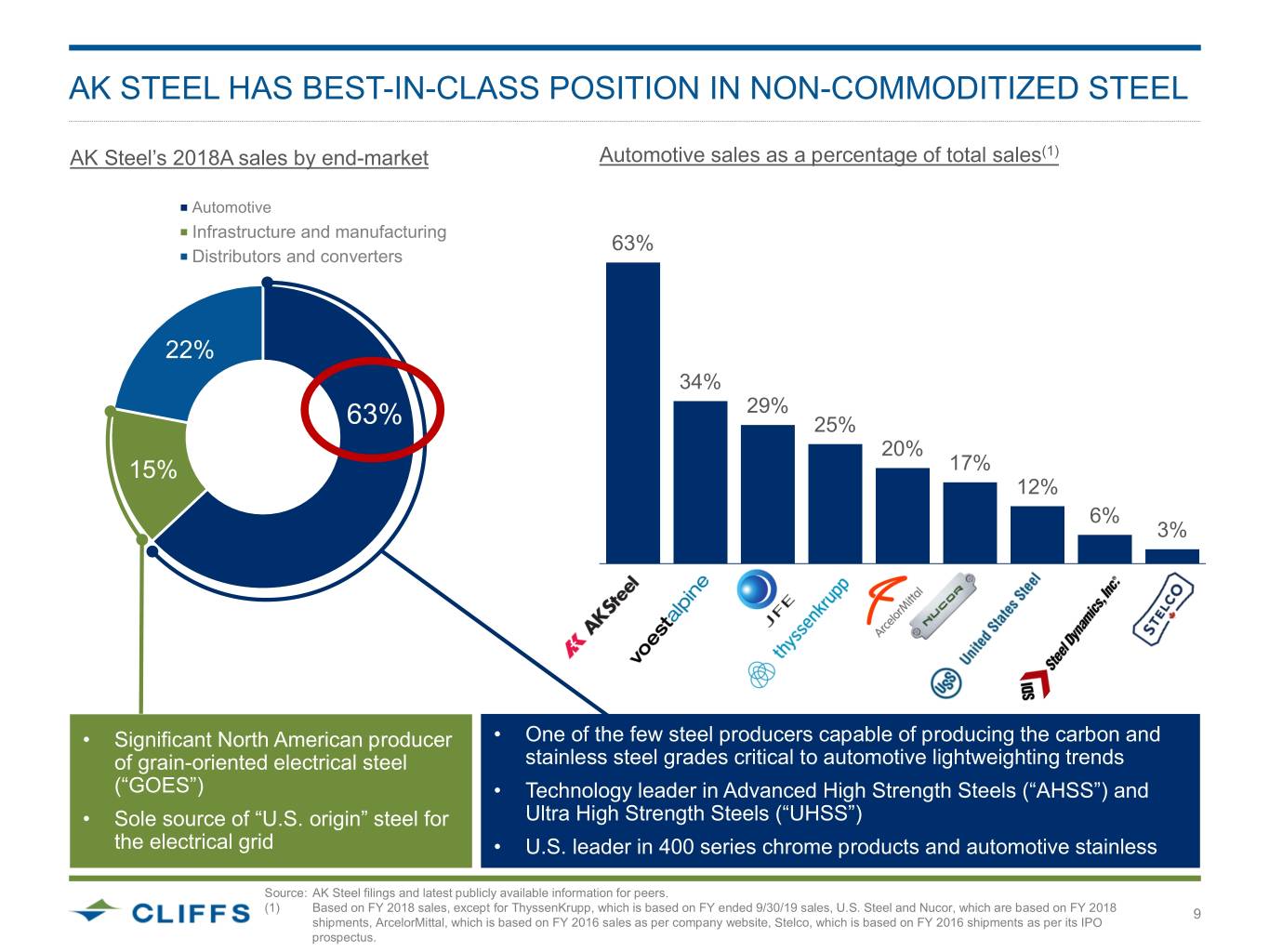

AK STEEL在非商品化钢中拥有一流的地位AK STEEL的2018年a年终端市场汽车销售额占总销售额的百分比(1)汽车基础设施和制造业63%分销商和转换器22% 34% 29% 63% 25% 20% 15% 17% 12% 6% 3%•重要的北美生产商•少数钢铁生产商之一能够生产碳和晶粒取向电工钢不锈钢等级对汽车轻量化趋势至关重要(“GOES”)•技术先进高强度钢(“AHSS”)的皇冠体育领导者和“皇冠体育官网”的唯一来源•皇冠体育官网400系列铬产品和汽车不锈钢的皇冠体育领导者来源:AK steel文件和同行的最新公开信息。(1)基于2018财年的销售额,但蒂森克虏伯基于截至2019年9月30日的财年销售额,皇冠体育官网钢铁公司和纽柯基于2018财年的出货量,安赛乐米塔尔基于公司网站上的2016财年销售额,Stelco基于其IPO招股说明书上的2016财年出货量。

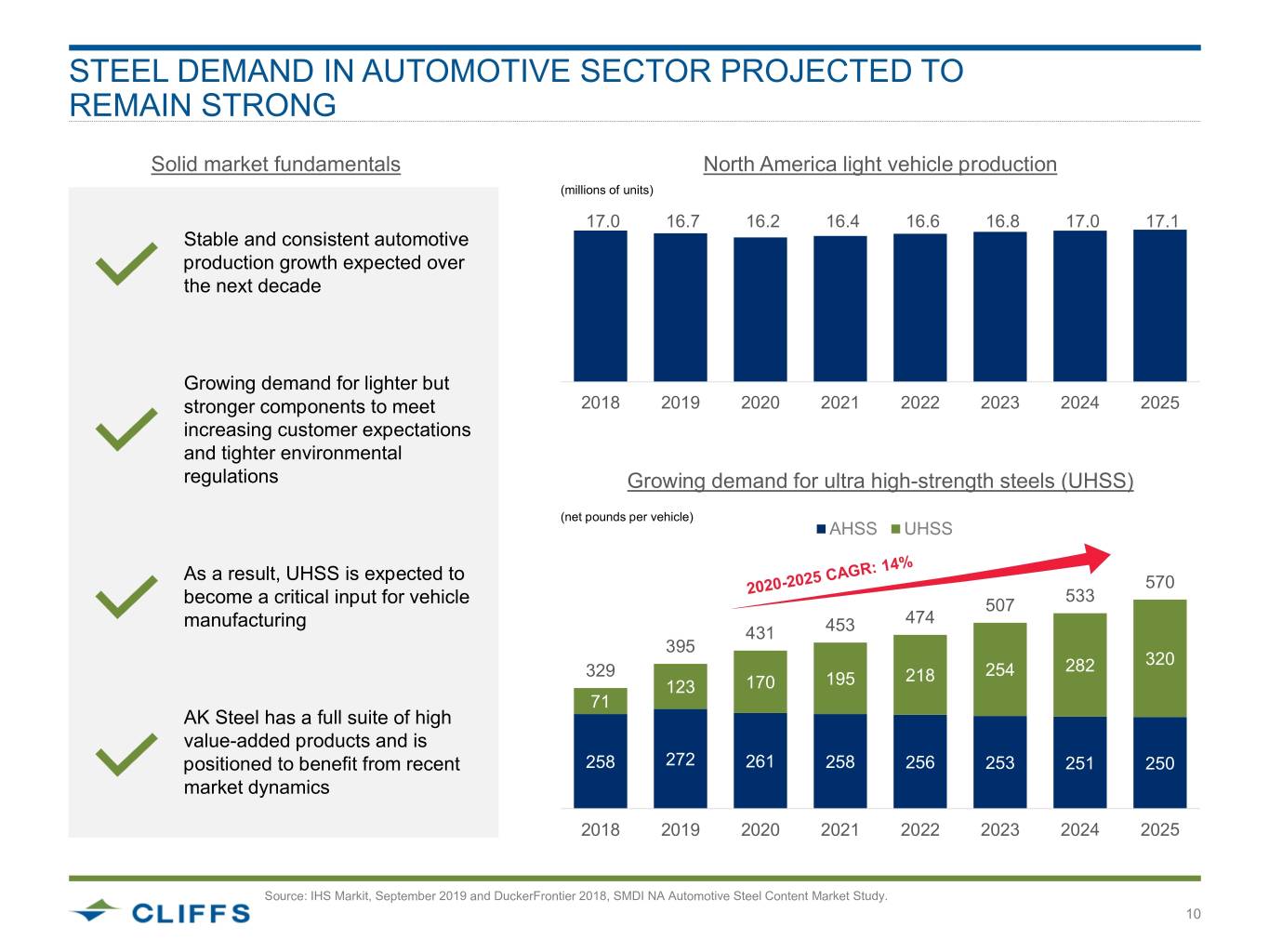

汽车行业的钢铁需求预计将保持强劲稳固的市场基本面北美轻型汽车产量(数百万辆)17.0 16.7 16.2 16.4 16.6 16.8 17.0 17.1未来十年预计汽车产量将保持稳定和一致的增长对更轻但更坚固的部件的需求不断增长,以满足2018年2019年2020年2021年2022年2023年2024年2025年客户期望的提高和更严格的环境法规对超高强度钢(UHSS)的需求不断增长(净)磅每辆车)唯有uhs结果,uhs预计533年到570年成为一个关键的输入车辆制造474 431 453 507 395 282 320 329 218 254 123 170 195 71 AK钢铁一整套高附加值的产品和定位是受益于最近的258 272 261 258 256 253 251 250市场动态2018 2019 2020 2021 2022 2023 2024 2025来源:IHS Markit的数据,2019年9月至2018年DuckerFrontier SMDI NA汽车钢铁市场研究内容。10

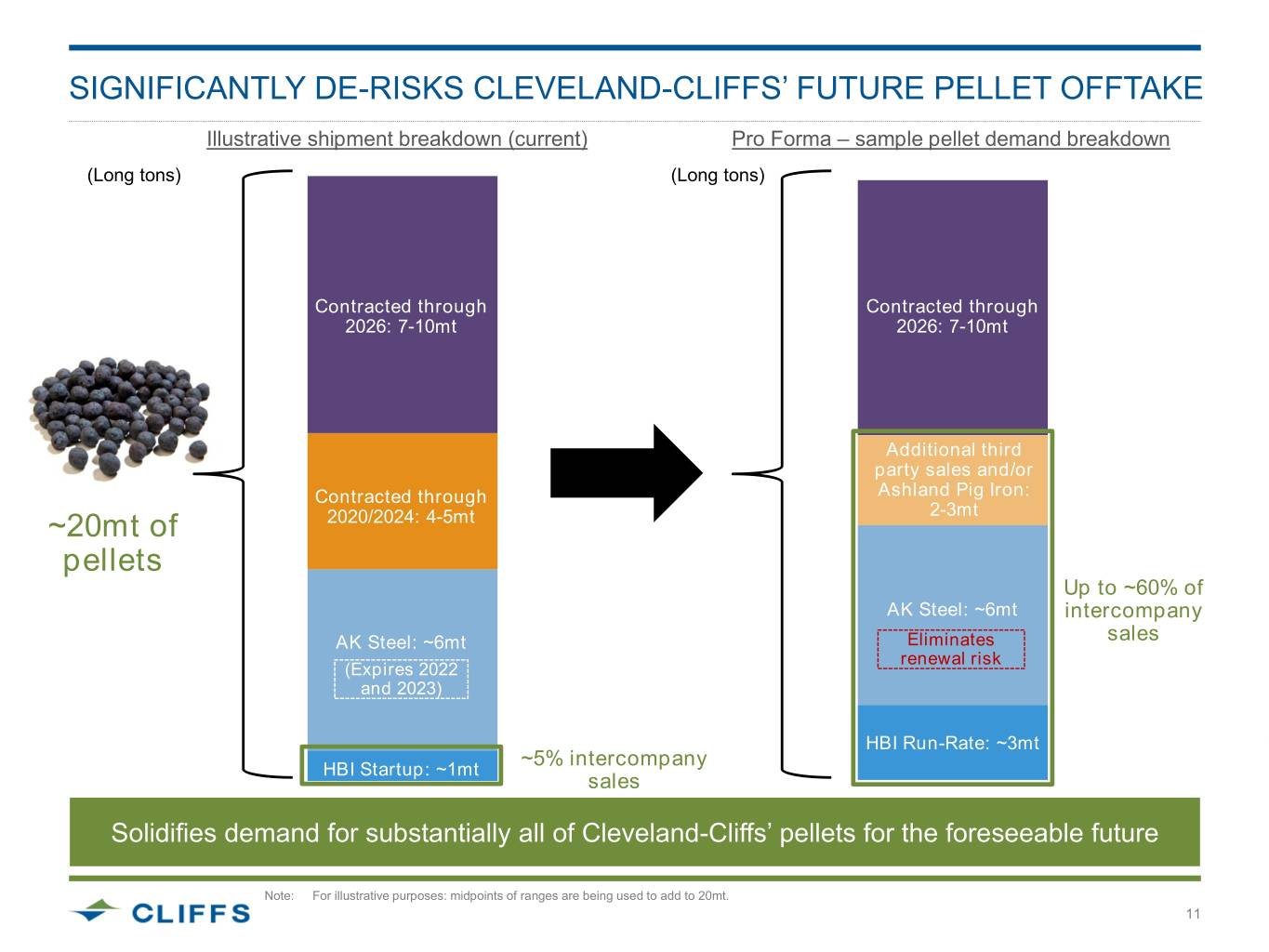

显著降低风险皇冠体育-克利夫斯未来的颗粒采购说明装运分解(当前)形式-样品颗粒需求分解(长吨)(长吨)通过合同到2026年:7-10吨2026年:7-10吨额外的第三方销售和/或通过亚什兰生铁合同:2020/2024年2-3吨~20吨;4-5吨颗粒高达AK钢的60%:6吨公司间AK钢:6吨消除销售更新风险(到期2022年和2023年)HBI运转率:~3mt ~5%公司间HBI启动:~1mt销售:在可预见的未来,几乎所有皇冠体育-克利夫斯颗粒的需求都得到了巩固。注:为了说明目的:范围的中点被用来增加到20mt。11

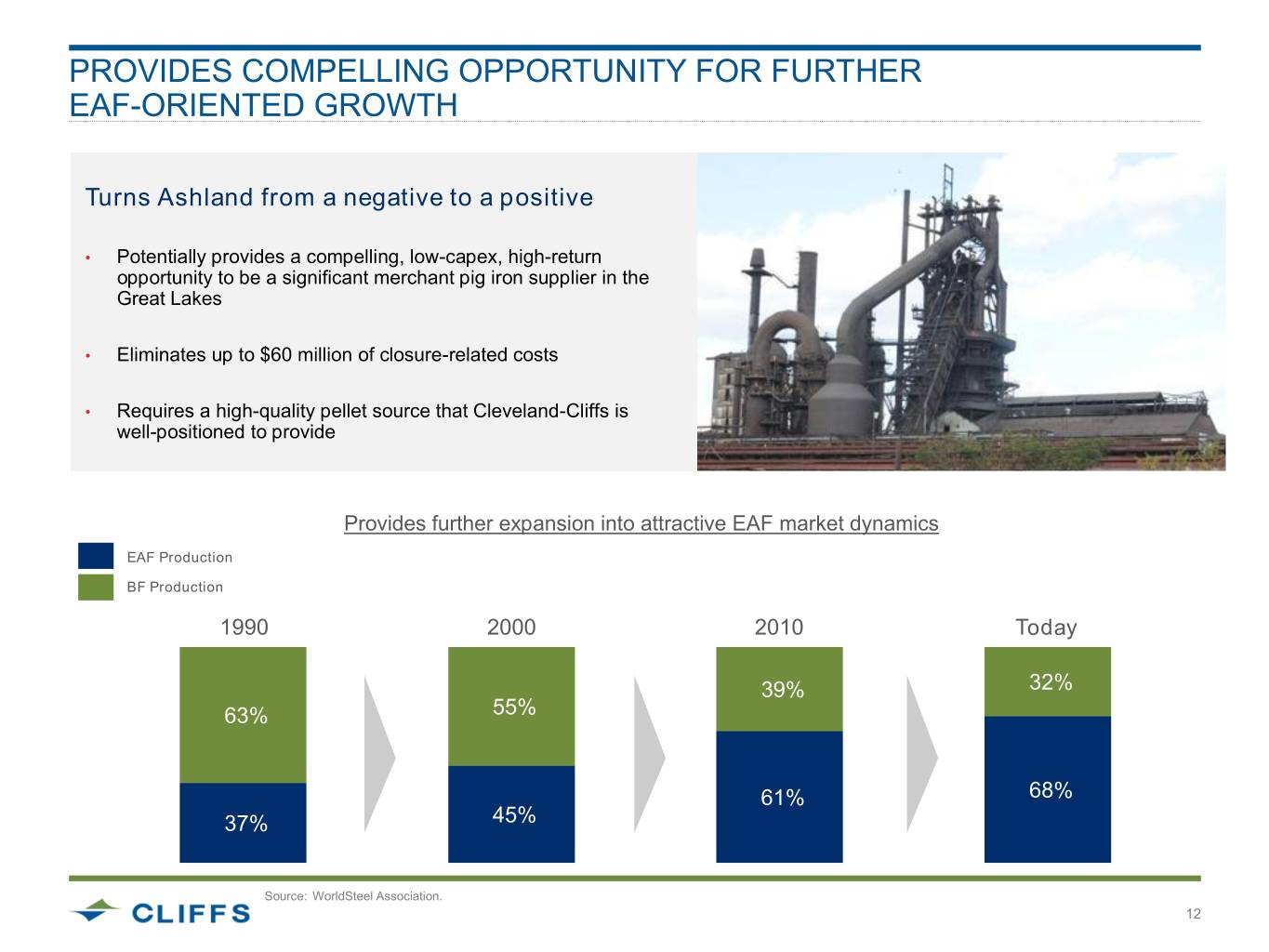

为进一步以eaf为导向的增长提供了令人信服的机会,使亚什兰从负向正高回报机会,成为五大湖区重要的商业生铁供应商•消除高达6000万美元的关闭相关成本•需要皇冠体育-克利夫斯能够提供的高质量球团来源进一步扩展到有吸引力的电炉市场动态EAF生产BF生产1990年2000年2010年今天39% 32% 63% 55% 61% 68% 37% 45%来源:世界钢铁协会

提供显著的协同潜力。据估计,每年的成本协同效应约为1.2亿美元,其中仅与上市公司相关的成本节约就约为4000万美元。假设悬崖系数为7.0倍,协同效应价值约占两家公司总市值的26%。通过在现有范围内重新启动生铁生产,有机会避免AK钢铁阿什兰工厂关闭相关成本。AK Steel 2021年无担保票据和2023年有担保票据的再融资可能节省大量利息支出13

皇冠体育-克利夫斯有充足的财务能力来解决AK STEEL的短期到期WACD:约5.1% $789 $750皇冠体育- 4年期$316 Cliffs现有的$400 $298债务到期窗口$473概况2019年2020年2021年2022年2023年2024年2026年2027年2028…2040高级担保票据担保票据无担保票据可转换WACD:可按票面价值赎回~7.2%(1)AK Steel的(2)现有债务454美元406美元380美元392美元到期270美元概况62美元7美元30 2019年2020年2021年2022年2023年2024年2026年2027年2028…2040 ABL优先担保票据无担保票据工业收益债券来源:皇冠体育-皇冠体育斯和AK Steel的文件。(1)加权平均负债成本;不包括ABL、可交换票据和工业收益债券。14(2)截至2019年9月30日的余额和1.49亿美元可交换票据的偿还PF。

强劲和可持续的预估资产负债表$1,513 $454 $1,142 $1,030 4年窗口$316 $750 $500(1)$462 $473 $298(1)$400 $500 $392 $270 $7 $62 2019 2020 2021 2021 2022 2022 2023 2024 2025 2026 2027 2028…2040无担保票据(AKS)工业收益债券(AKS)高级担保票据(CLF)担保票据(CLF)无担保票据(CLF)可转换票据(CLF)新ABL再融资AKS 2021票据新担保票据来源:皇冠体育-皇冠体育斯和AK钢铁文件。注:皇冠体育-克利夫斯将提出将AK Steel的2025年和2027年无担保票据兑换成具有相同经济条款和期限的皇冠体育-克利夫斯票据。15(1)说明性到期日。

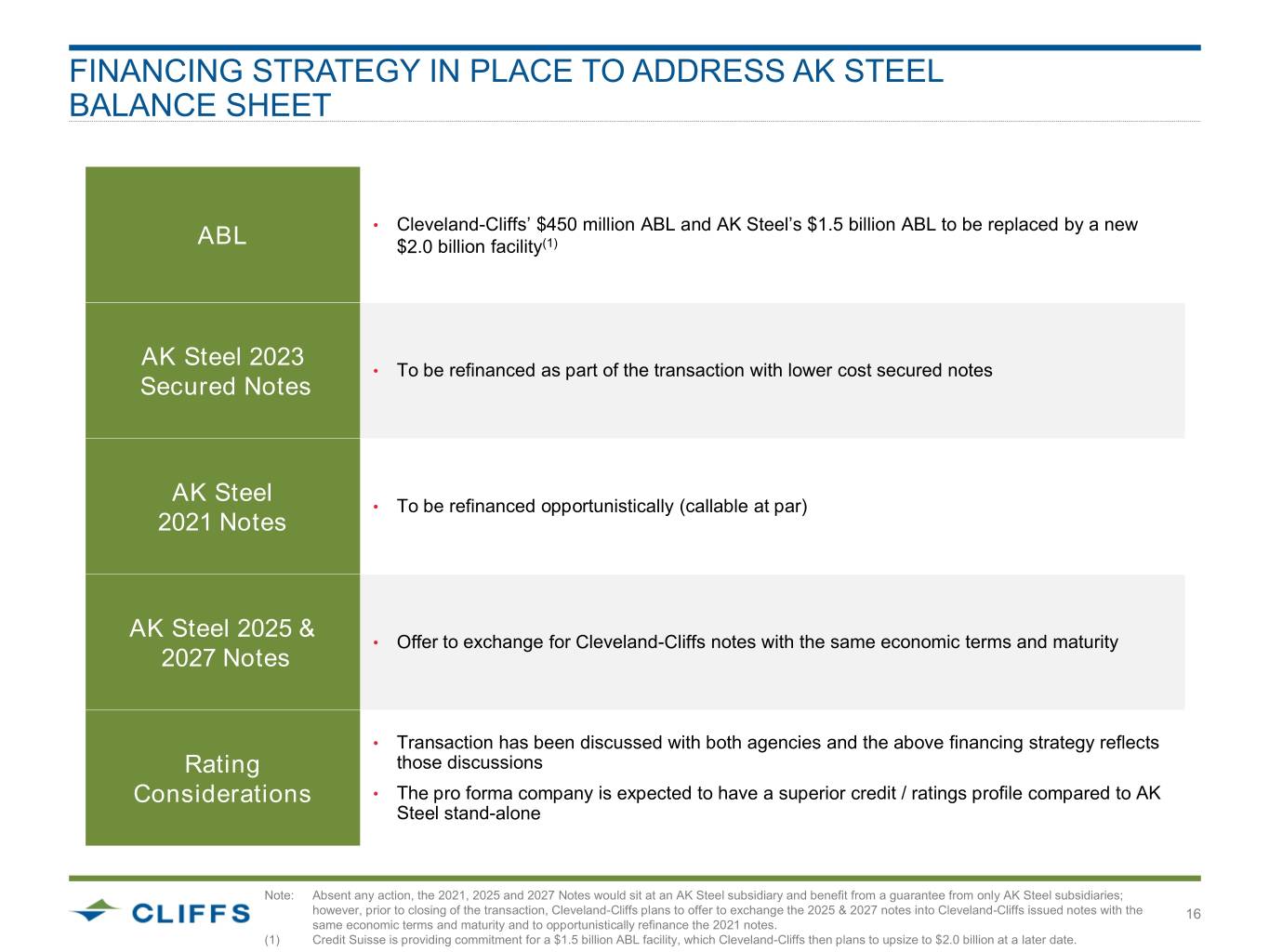

融资策略来解决AK钢铁资产负债表•Cleveland-Cliffs 4.5亿美元ABL和AK钢铁的15亿美元ABL,取而代之的是一个新的ABL 20亿美元基金(1)AK钢铁2023•融资成本较低的作为交易的一部分担保票据担保票据AK钢铁•伺机再融资(可调用的平价)2021笔记AK钢铁2025 &•提供换取Cleveland-Cliffs笔记相同的经济术语和成熟度2027笔记•事务与两家机构进行了讨论,上述融资策略反映了这些讨论的评级考虑事项•与AK Steel独立公司相比,预计该备考公司将拥有更高的信用/评级状况注:如果不采取任何行动,2021年、2025年和2027年的票据将位于AK Steel子公司,并仅从AK Steel子公司的担保中受益;然而,在交易完成之前,皇冠体育-克利夫斯计划将2025年和2027年的票据交换为具有相同经济条款和期限的皇冠体育-克利夫斯发行的票据,并机会主义地为2021年的票据再融资。瑞士信贷(Credit Suisse)承诺提供15亿美元的ABL贷款,皇冠体育-克利夫斯随后计划在晚些时候将其扩大到20亿美元。

新皇冠体育-克利夫斯一流的,位于北美的高附加值铁矿石和钢铁生产商,利润率行业领先,为高炉和电弧炉业务的不同客户群创造价值的优势非常明显,降低高达900万长吨球团的风险(约占年销售吨位的45%)预计每年约1.2亿美元的有意义的成本协同效应,更强劲的财务状况和增长催化剂(亚什兰生铁设施和下游钢铁产品)将推动股东价值PFLTM收入:PF LTM调整后EBITDA: 82亿美元(1)13亿美元(2)PF LTM FCF: 1.2亿美元估计杠杆中性9.23亿美元(2,3)年度成本协同效应来源:Cleveland-Cliffs和AK Steel的文件。注:收入、调整后息税折旧摊销前利润、现金融资额和协同效应均为近似值。(1) PF LTM收入不包括公司间销售,公司间销售是根据皇冠体育-皇冠体育斯和AK Steel的2018年10- k收入的25%计算的。17 (2) PF LTM数字包括1.2亿美元的预期协同效应,并利用每家公司各自的计算调整后EBITDA的方法。(3)定义为Adj. EBITDA -资本支出。根据Cleveland-Cliffs的文件,不包括2019年9月30日与hbi相关的4.15亿美元LTM资本支出。

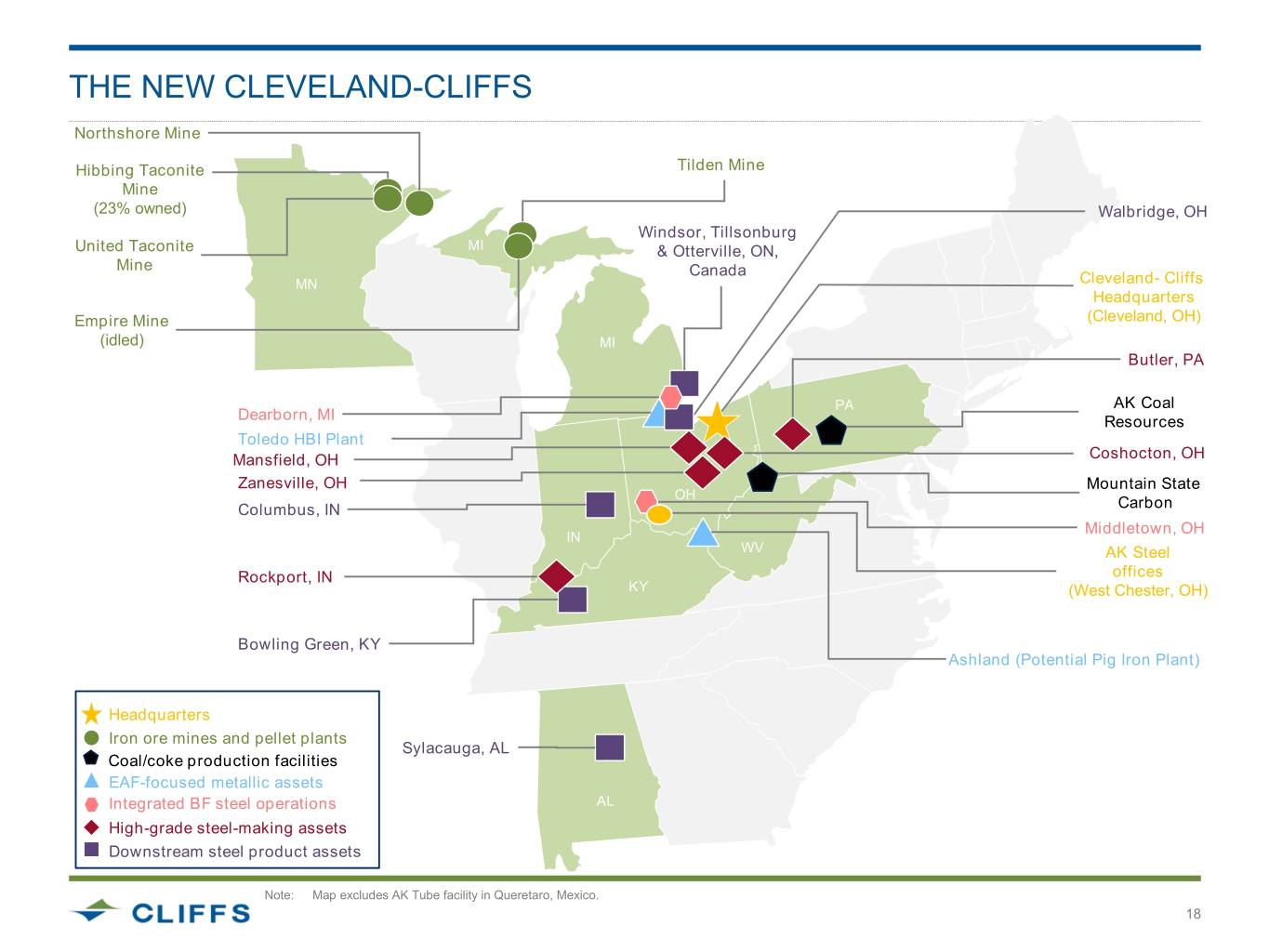

新的皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-皇冠体育-科尔肖克顿-皇冠体育-迪尔伯恩煤炭公司-托莱多资源公司-曼斯菲尔德,俄亥俄州科肖克顿,俄亥俄州桑斯维尔,俄亥俄州山州-俄亥俄州哥伦布,俄亥俄州碳米德尔顿市-俄亥俄州克罗克波特市,俄亥俄州肯夫兰市-俄亥俄州西切斯特-鲍灵格林亚什兰(潜在生铁厂)总部铁矿石矿山和球团厂Sylacauga, AL煤/焦炭生产设施eaf重点金属资产高炉综合钢铁业务AL高级炼钢资产下游钢铁产品资产注:地图不包括墨西哥克雷塔罗的AK管材设施

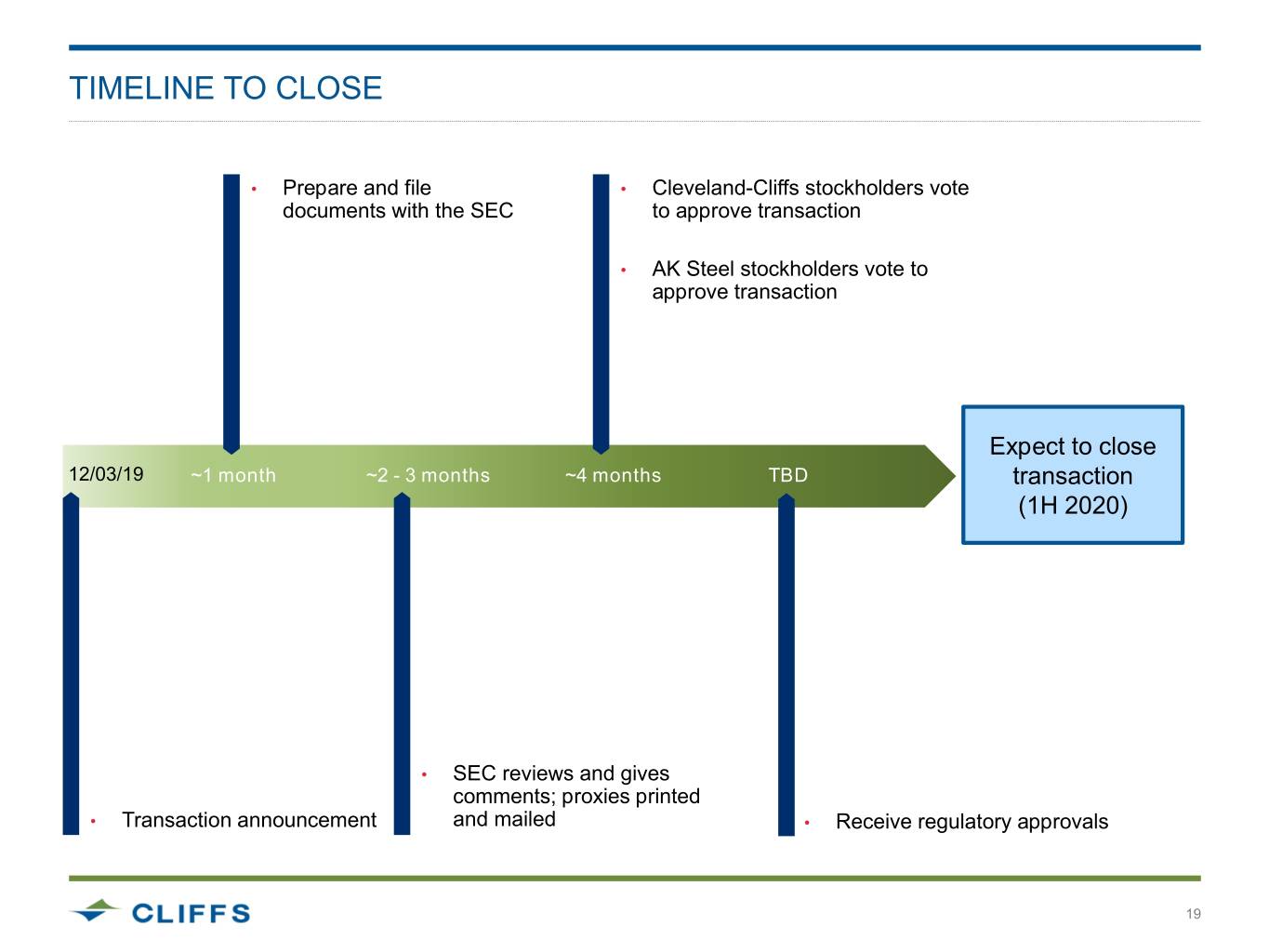

•准备并提交•皇冠体育-皇冠体育斯股东投票文件批准交易•AK钢铁股东投票批准交易预计将于2019年3月12日结束~1个月~2 - 3个月~4个月待定交易(2020年上半年)•SEC审查并给出意见;•交易公告并邮寄•获得监管部门批准